QuickBooks Payroll Errors

Let’s Dive in to see types of QuickBooks Payroll Errors.

How to fix QuickBooks Payroll Errors?

QuickFix Bookkeeping has crafted some DIY resources to help you with QB payroll errors, it can cause payroll delays and tax issues.

Our expert team can swiftly resolve these errors, too.

We are just a phone call away.

* All trademarks and logos are the property of their respective owners. These are used for visual reference only.

QuickBooks Payroll-Specific Errors

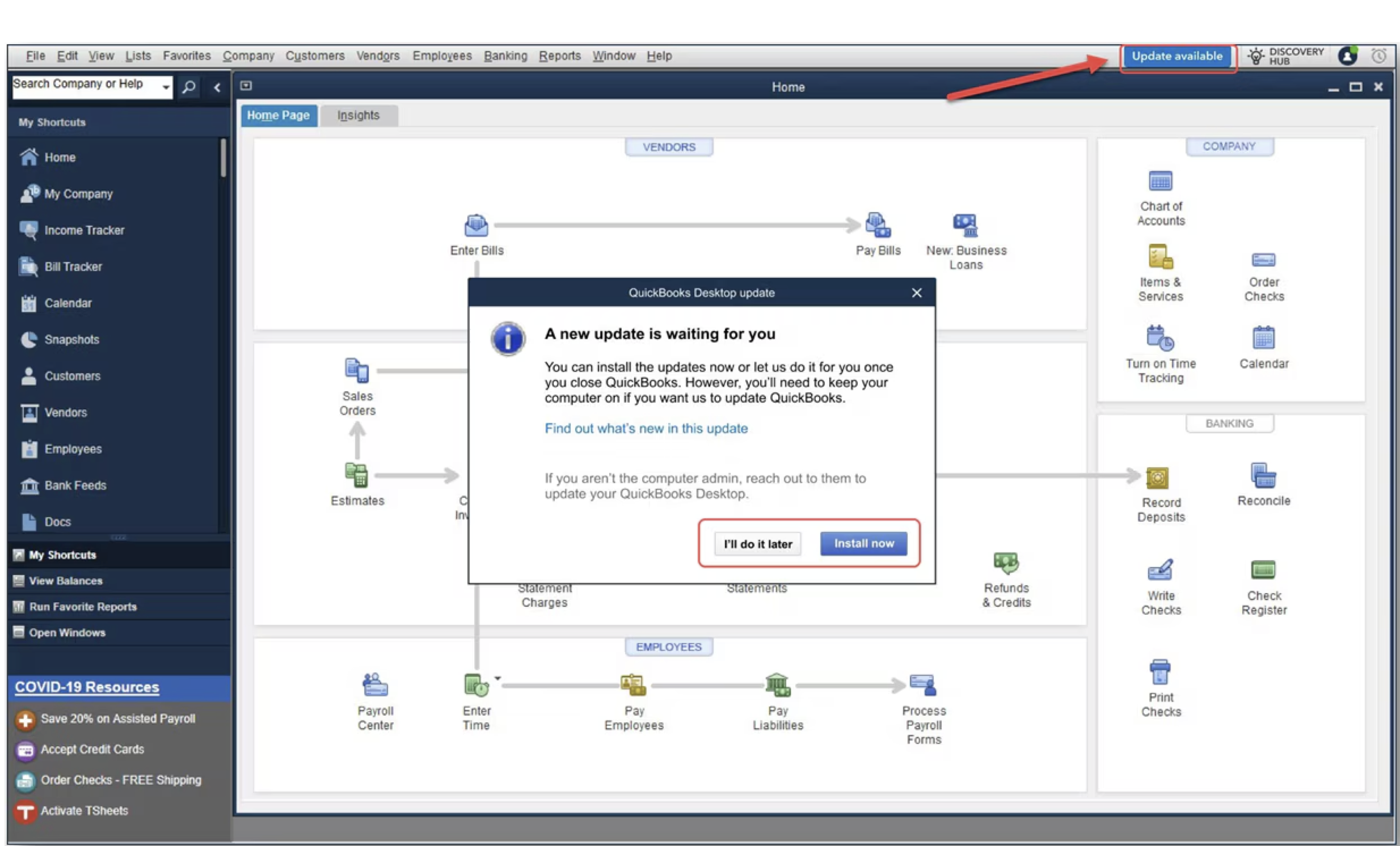

Error Code – 15xxx Series (e.g., 15215, 15243, 15271)

Error Description / Category

Payroll Update Errors. Occur when QuickBooks is unable to download or install the latest payroll tax table updates.

Complexity

Medium

Common Resolution Steps

1. Check System Time and Date: Ensure the date, time, and time zone on your computer are correct.

2. Verify Internet Settings: Make sure you have a secure internet connection. Check that your Internet Explorer (or other browser) settings are not blocking the updates (e.g., reset advanced settings).

3. Firewall & Security Software: Temporarily disable your firewall, antivirus, or other security software to see if it’s blocking QuickBooks from connecting to Intuit servers.

4. Run as Administrator: Right-click the QuickBooks icon and select “Run as administrator.”

5. Clean Update: Go to Employees > Get Payroll Updates, check Download Entire Update, and then click Update.

6. Rename CPS Folder: Navigate to C:\Program Files\Intuit\QuickBooks 20xx\Components\Payroll\CPS and rename the CPS folder to CPSOLD. Retry the update.

Error Code – PS033, PS036, PS077

Error Description / Category

PS Series Errors. “PS” stands for Payroll Service. These errors are often related to a damaged company file, an invalid payroll service key, or an issue with the payroll tax table download.

Complexity

Medium

Common Resolution Steps

1. Update QuickBooks: Ensure your QuickBooks program is on the latest release.

2. Download Updates: Go to Employees > Get Payroll Updates to download the most recent tax table.

3. Verify and Rebuild Data: Use the built-in Verify Data and Rebuild Data tools (File > Utilities) to check for and fix company file damage.

4. Check Service Key: Verify that the payroll service key is entered correctly.

Error Code – PS038

Error Description / Category

Payroll Subscription Error. This error indicates a problem with the payroll subscription’s status, either that it is inactive or has been suspended.

Complexity

Low

Common Resolution Steps

1. Verify Subscription Status: Log in to your Intuit account to confirm that your payroll subscription is active and in good standing.

2. Update Billing Info: If the subscription has expired, update your billing information and reactivate it.

3. Reset Service Key: Go to Employees > My Payroll Service > Manage Service Key to reset or re-enter the key.

Error Code – Error 30159

Error Description / Category

EIN (Employer Identification Number) Mismatch. Occurs when the EIN in your QuickBooks company file does not match the one registered with your payroll subscription on Intuit’s servers.

Complexity

Low

Common Resolution Steps

1. Verify EIN: In QuickBooks, go to Company > My Company and confirm that the EIN is correct.

2. Re-enter Service Key: Re-enter your payroll service key to force QuickBooks to re-validate the EIN with Intuit.

Error Code – Direct Deposit Issues

Error Description / Category

Direct Deposit Failure. This is a common issue that isn’t always associated with a single error code. It can be caused by incorrect bank information, insufficient funds, or a submission that is too close to the check date.

Complexity

Medium

Common Resolution Steps

1. Check Bank Account: Ensure the bank account information for the employee and your company is correct.

2. Check Funds: Verify that your bank account has sufficient funds to cover the payroll before submitting.

3. Review Submission Timeline: Remember that direct deposit requires a minimum of two business days to process. Check if the submission was made on time.

4. Cancel/Void Paycheck: If the direct deposit is still pending, you may be able to cancel it. If it has been processed, you will need to void the check and make a manual adjustment.

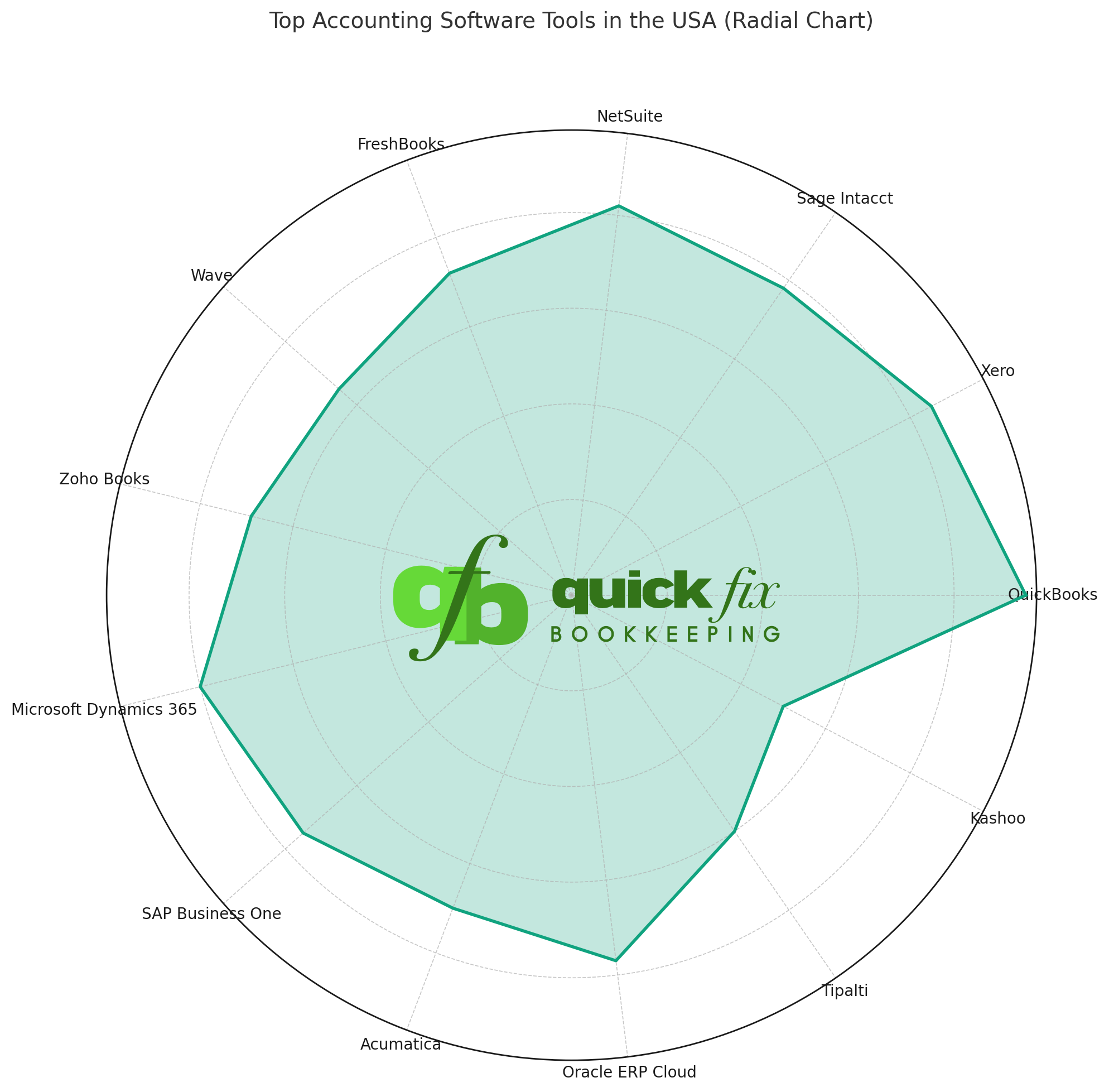

The QuickFix Solution: Secure & Stress-Free Migration

-

At QuickFix Bookkeeping, we take the worry out of migration. We handle the entire process, from initial data assessment to final setup and training.

-

Our expert team ensures a flawless transfer of your financial data, including historical transactions, customer lists, vendor information, and more.

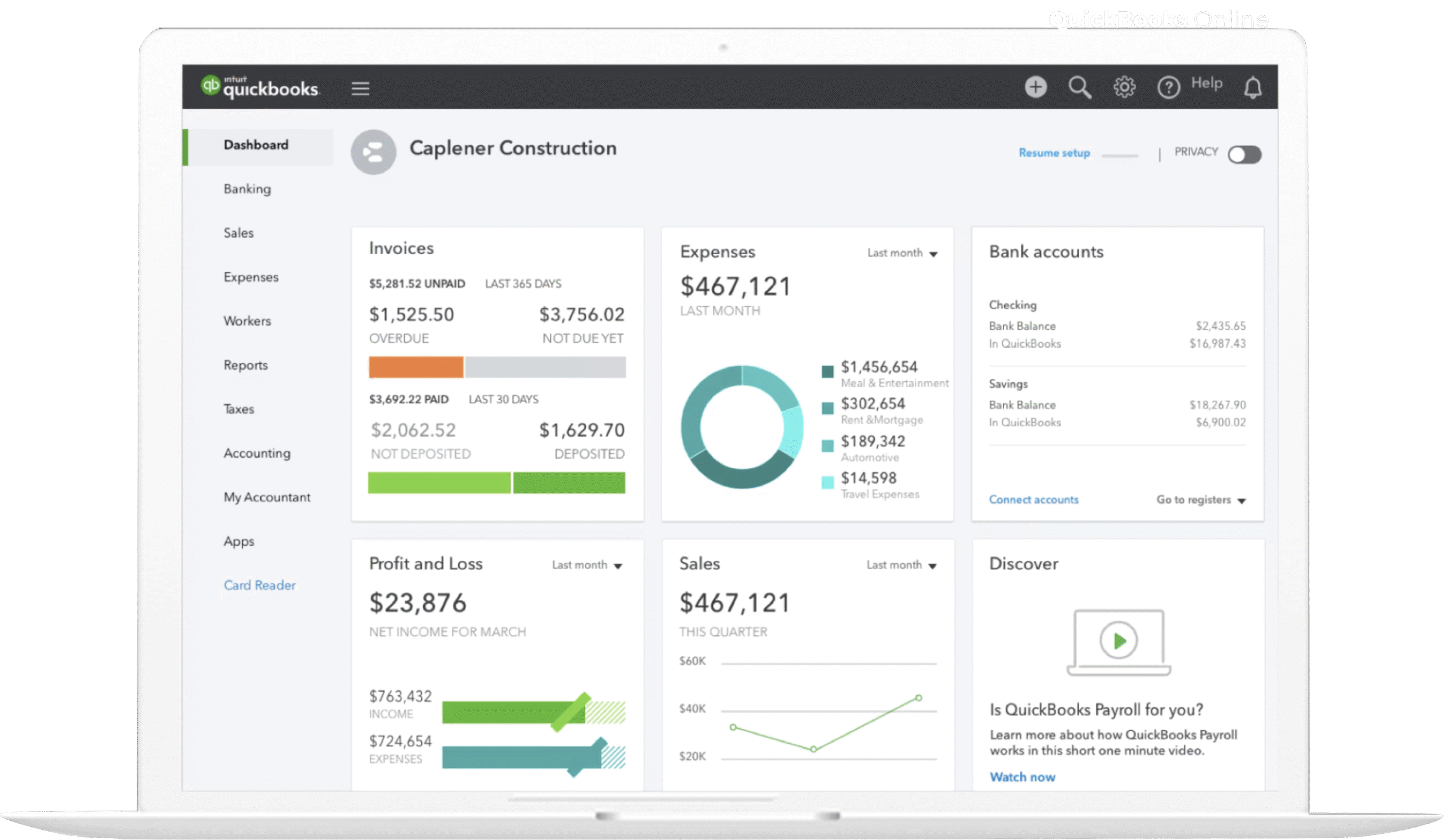

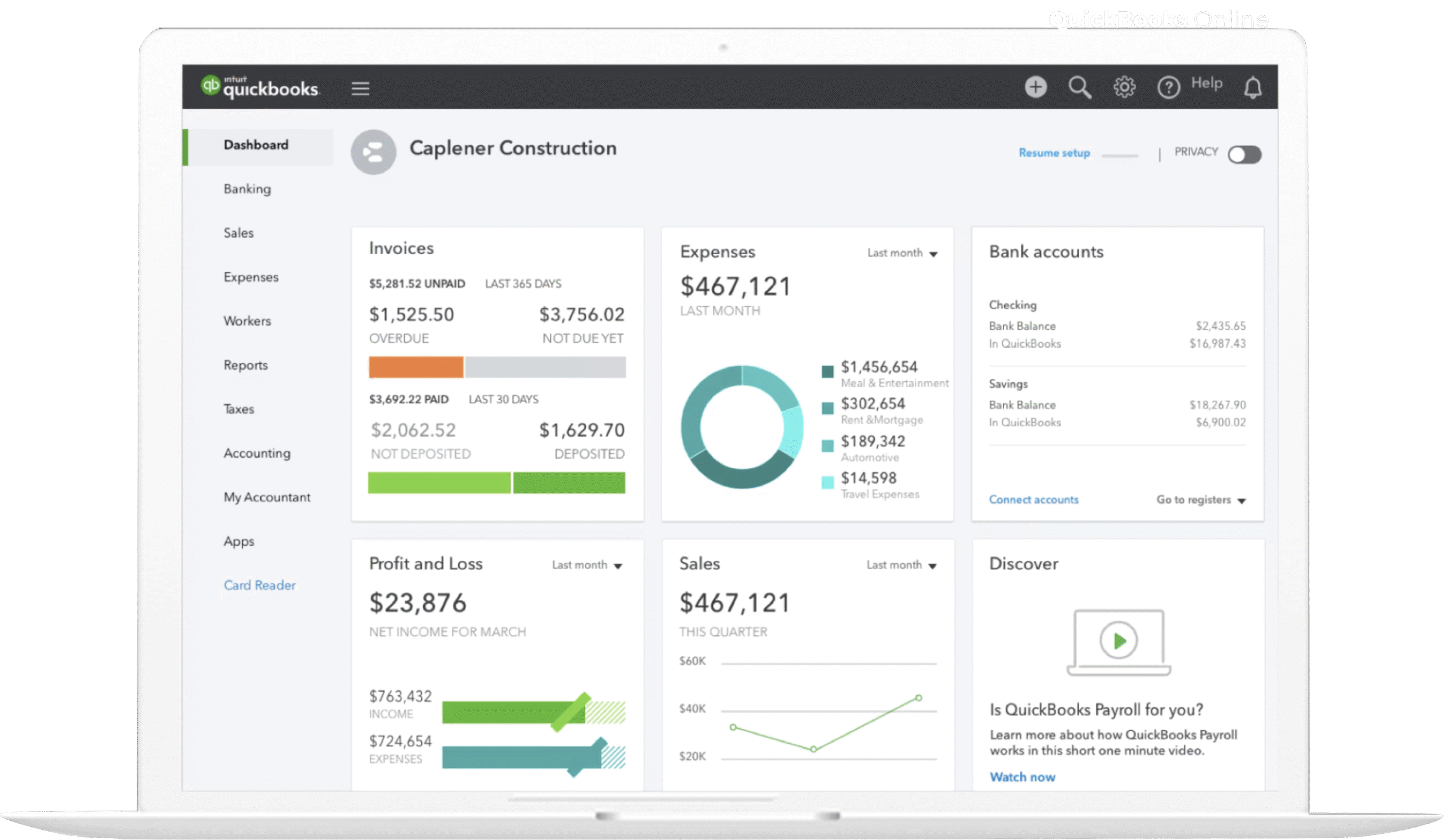

Whether you prefer the power of a locally installed system or the flexibility of cloud-based access, we are experts in both. We’ll help you decide which one is the perfect fit for your business needs.

The Power of QuickBooks Desktop: Uncompromised Control.

Ideal for businesses that require robust reporting, multi-user access on a local network, or industry-specific functionalities (e.g., inventory management). We ensure a seamless transfer of your complex data from other systems or older versions of QuickBooks to the latest Desktop platform.

Key Benefits:

-

- Full data transfer including historical data.

- Installation and setup on your local network.

- Custom chart of accounts and item setup.

- Post-migration support and training.

The Freedom of QuickBooks Online: Access Anywhere, Anytime.

Perfect for business owners who need to manage their finances on the go, collaborate with their team or accountant easily, and access real-time financial data from any device. We’ll make your move to the cloud simple and secure.

Key Benefits:

-

-

Secure transfer of all financial records to the cloud.

-

Connecting bank and credit card accounts.

-

Setup of cloud-based invoicing and payment systems.

-

Training on the QBO interface and mobile app.

-

Our Migration Process: Quick, Easy, and Secure

At Quickfix Bookkeeping, we understand that migrating accounting software can feel daunting. Our expert team follows a meticulous, three-step process to ensure a flawless transition with minimal disruption to your business operations.

1. Consultation & Assessment:

We discuss your business needs, review your current software, and recommend the best QuickBooks platform (Desktop or Online) for you.

2. Secure Migration:

Our team executes the data transfer, meticulously checking for accuracy and integrity. We’ll keep you informed every step of the way.

3. Final Setup, Training & Ongoing Support:

We finalize your setup, connect bank feeds, and provide personalized training to you and your team so you can hit the ground running.

Why Trust QuickFix Bookkeeping With Your Financial Data?

- Expertise: Our team consists of Certified QuickBooks ProAdvisors with years of experience in data migration.

- Security: We use industry-leading security protocols to ensure your sensitive financial data is protected throughout the entire process.

- Personalized Service: We don’t believe in one-size-fits-all solutions. We take the time to understand your unique business needs and recommend the best path forward.

- Peace of Mind: With our meticulous process and ongoing support, you can be confident that your transition will be accurate and hassle-free.

Frequently Asked Questions

What is a data migration and why do I need it?

Data migration is the process of securely transferring all your financial information—including customer lists, vendor details, historical transactions, and reports—from your current accounting system to a new one, like QuickBooks Desktop or QuickBooks Online. You need it to ensure all your financial records are complete and accurate in your new system, preventing data loss and a disorganized transition.

How long does the migration process take?

The duration of the migration depends on the complexity and volume of your data. A simple file may take a few hours, while a larger, more complex file with extensive history could take a few days. We provide a clear timeline during your initial consultation.

What data can be migrated?

We can migrate a comprehensive range of data, including:

-

Chart of Accounts

-

Customer and Vendor Lists

-

Historical Invoices and Bills (paid and unpaid)

-

Banking and Credit Card Transactions

-

Journal Entries

-

Inventory Items (with some limitations)

-

Payroll history (with specific conditions)

Will I lose any data during the migration?

Our professional process is designed to prevent data loss. We always start by creating a full backup of your original file before beginning any transfer. We also perform a post-migration audit to ensure the data in your new QuickBooks file matches the source data.

Can I access my old data after the migration?

Yes. We will not alter your original accounting file. Your old data will remain intact, allowing you to access it for historical reference or in case you need to run specific reports from the past.

Why should I migrate to QuickBooks Desktop?

QuickBooks Desktop is ideal for businesses that prefer a powerful, locally-installed accounting solution. It offers robust reporting, advanced inventory management, and industry-specific versions (e.g., Contractor, Manufacturing & Wholesale), providing more control and functionality for complex business needs.

Can you migrate my data from an older version of QuickBooks Desktop to a newer one?

Absolutely!

This is a common service we provide. We’ll upgrade your company file to the latest version of QuickBooks Desktop, ensuring you have access to the newest features and security updates. We have Certified PRO Advisors to take care all your QuickBooks needs.

What about my multi-user setup and integrations?

We’ll assist with the installation and configuration of QuickBooks Desktop across your network for multi-user access. We also help reconnect your business applications and third-party integrations to the new file.

Why should I migrate to QuickBooks Online?

QuickBooks Online (QBO) offers the flexibility of a cloud-based platform. It’s perfect for business owners who need to access their financials from anywhere, on any device. QBO also simplifies collaboration with your accountant and automates many tasks, such as bank feeds and invoicing.

What are the main differences between QuickBooks Desktop and QuickBooks Online for my business?

While both are powerful, QBO is designed for accessibility and automation, while QuickBooks Desktop offers deeper customization and offline functionality. We’ll work with you to analyze your business needs, such as multi-user requirements, inventory complexity, and reporting needs, to recommend the best option.

Will my bank and credit card transactions transfer automatically after the migration?

No, bank and credit card feeds are not automatically transferred. After the migration is complete, we’ll guide you through the process of securely linking your bank and credit card accounts to your new QuickBooks Online file to begin downloading new transactions.

How will my payroll data be handled during a migration to QuickBooks Online?

Due to the nature of payroll security and a different system structure, detailed payroll history (individual paychecks) may not transfer directly. We will ensure all employee information and year-to-date totals are set up correctly so you can continue running payroll seamlessly from your new QBO account.

Ready to Upgrade Your Bookkeeping?

Stop wasting time on outdated systems.

Let QuickFix Bookkeeping handle your migration so you can get back to growing your business.