QuickBooks Error Code C=225, 260, 265

Let’s Dive in to see…

How to Fix QuickBooks Error Code C=225, 260, 265

QuickFix Bookkeeping Guide: How to Fix QuickBooks Error Code C=225, 260, 265

Solving QuickBooks C-Series Errors: C=225, C=260, and C=265

If you are seeing an error code starting with “C,” you are likely dealing with a data integrity issue. These errors typically pop up when QuickBooks tries to read a report or a specific transaction and encounters a discrepancy in the database.

At QuickFix Bookkeeping, we know that seeing “C-Series” errors can be alarming because they often involve the structure of your financial data. The good news? Most of these are fixable with the right technical approach.

Breaking Down the Errors

While these codes are related, they usually trigger during different tasks:

-

Error C=225: This generally occurs when you try to run a report. It indicates that QuickBooks is having trouble locating a specific entry or that a header in the database is corrupted.

-

Error C=260: This is often linked to the QuickBooks PDF Converter or a failure to communicate with a driver when trying to print or email a transaction.

-

Error C=265: Usually appears when there is an inconsistency in the data during a “Verify” or “Rebuild” process, often involving an out-of-balance transaction.

Why Is This Happening?

These errors don’t happen at random. They are usually caused by one of the following:

- Damaged Company File: The internal “index” of your data has become scrambled.

- Outdated Software: You are running an old release of QuickBooks that hasn’t been patched for your current operating system.

-

Large Transaction Logs: Your

.TLG(Transaction Log) file has grown too large, causing the database to lag and “drop” connections to certain data points. - Network Drops: If you are working on a network and the connection flickers, the data packet being sent can become corrupted.

How to Resolve C-Series Errors

1. The “Verify and Rebuild” Solution

This is the most effective way to fix C-Series errors.

-

Go to File > Utilities > Verify Data. If it finds an issue, QuickBooks will prompt you to “Rebuild.”

-

Go to File > Utilities > Rebuild Data. Make sure to follow the prompts to save a backup before the process begins.

2. Rename the .TLG File

If the errors persist, your transaction log might be the culprit.

- Close QuickBooks.

- Open the folder where your company file is stored.

- Find the file with the same name as your company file but with a .TLG extension (e.g., CompanyData.qbw.tlg).

- Right-click and rename it to CompanyData.qbw.tlg.OLD.

- Reopen QuickBooks. A new, healthy log file will be created.

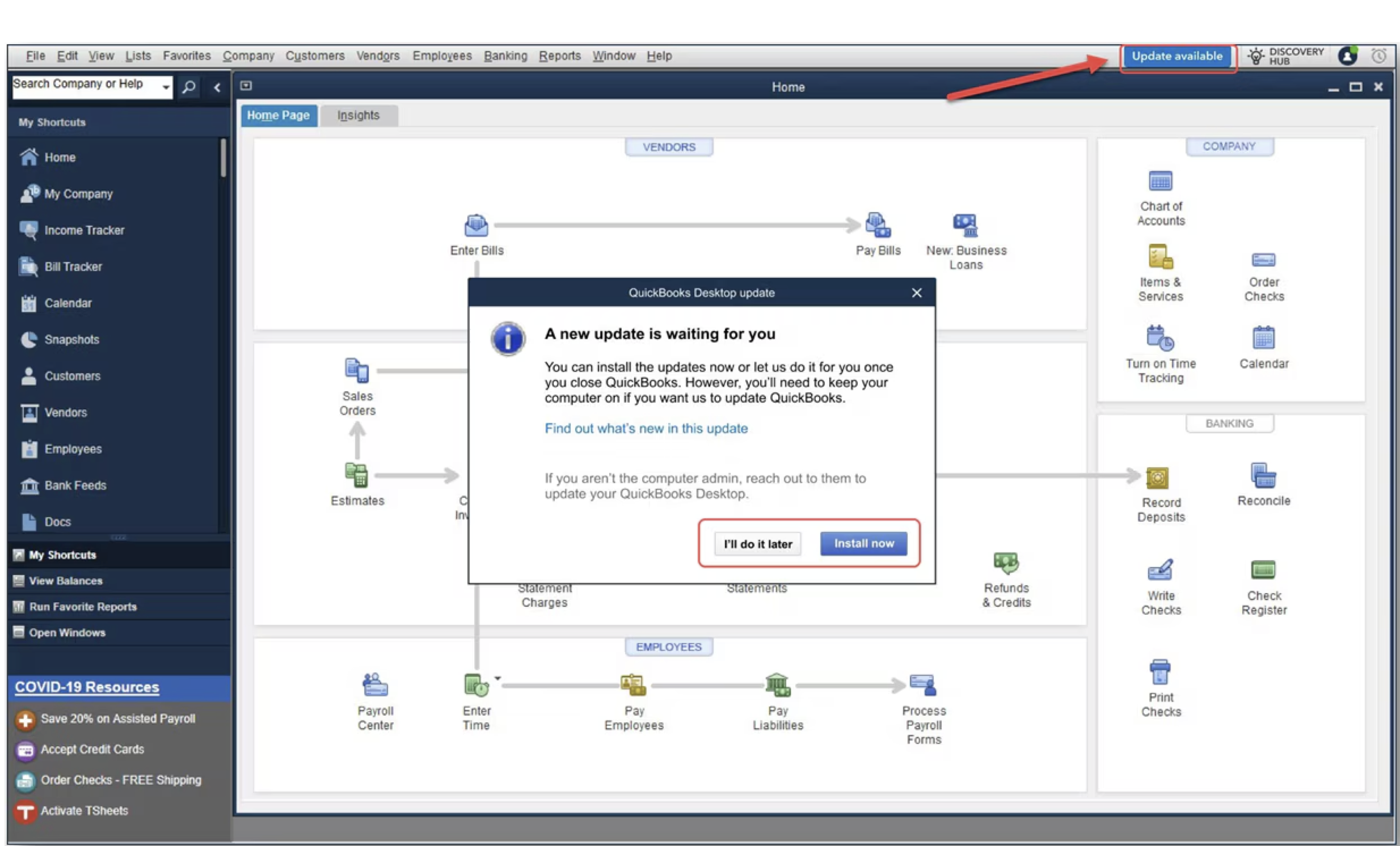

3. Update QuickBooks to the Latest Release

Sometimes the error is a known bug that Intuit has already patched.-

Go to Help > Update QuickBooks Desktop.

-

Click Update Now and ensure the Critical Fixes box is checked.

Professional Data Recovery Services

C-Series errors can sometimes be a warning sign of a failing hard drive or a more serious database corruption. If the “Rebuild” utility fails or the error returns immediately after fixing it, you need professional intervention to prevent total data loss.

At QuickFix Bookkeeping, we specialize in deep-level data repair. We can extract your data from damaged files and migrate it into a clean, stable shell to ensure your history remains intact.

Warning: Never ignore a C-Series error. Continuing to enter data into a file with integrity issues can make the damage permanent.

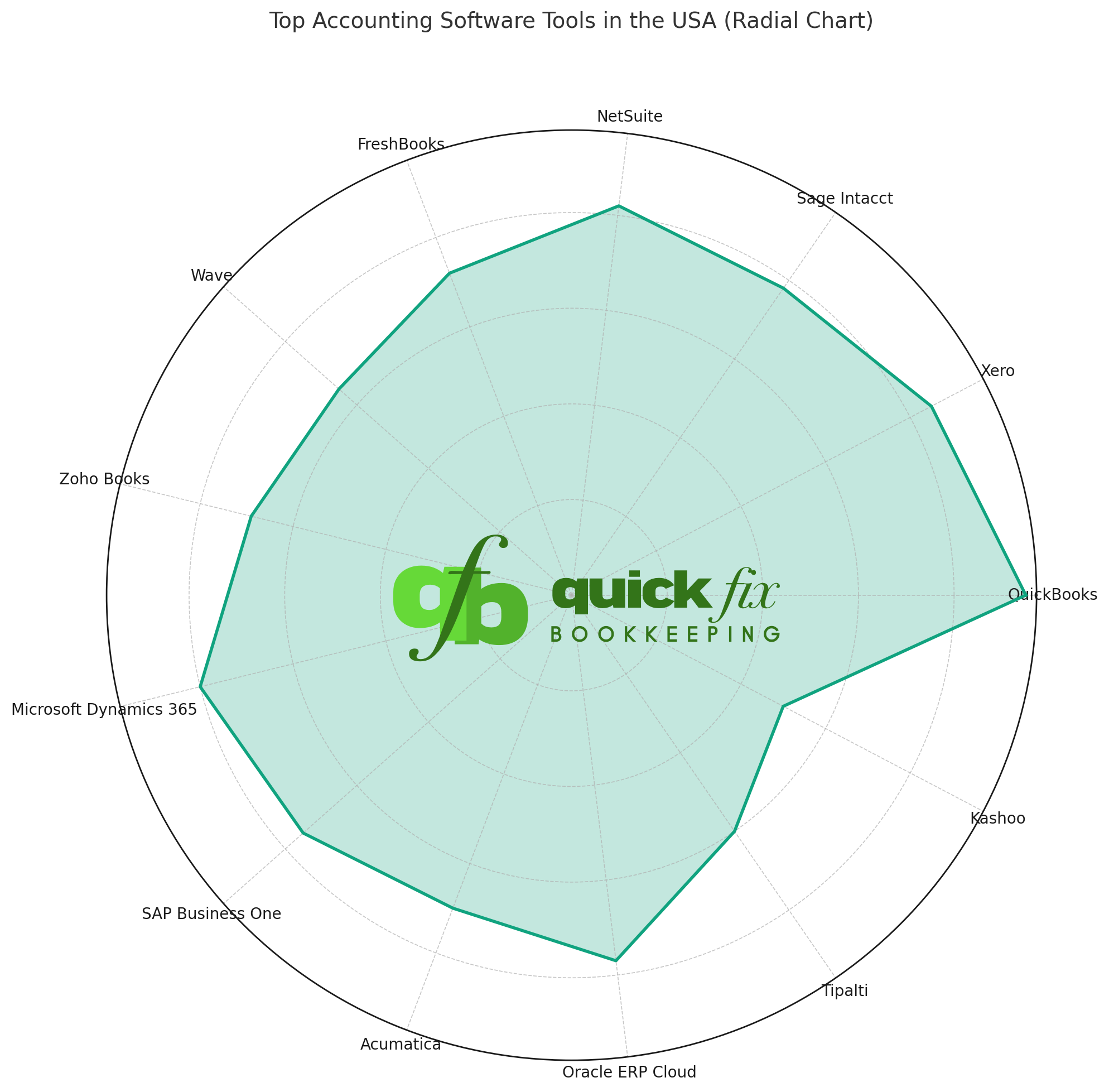

Why Choose QuickFix Bookkeeping?

-

Certified QuickBooks professionals

-

Fast and accurate error diagnosis

-

Secure data handling and recovery

-

Affordable, reliable support

-

Ongoing bookkeeping and QuickBooks assistance

We handle QuickBooks issues so you can focus on running your business.

The QuickFix Solution: Secure & Stress-Free Migration

-

At QuickFix Bookkeeping, we take the worry out of migration. We handle the entire process, from initial data assessment to final setup and training.

-

Our expert team ensures a flawless transfer of your financial data, including historical transactions, customer lists, vendor information, and more.

Whether you prefer the power of a locally installed system or the flexibility of cloud-based access, we are experts in both. We’ll help you decide which one is the perfect fit for your business needs.

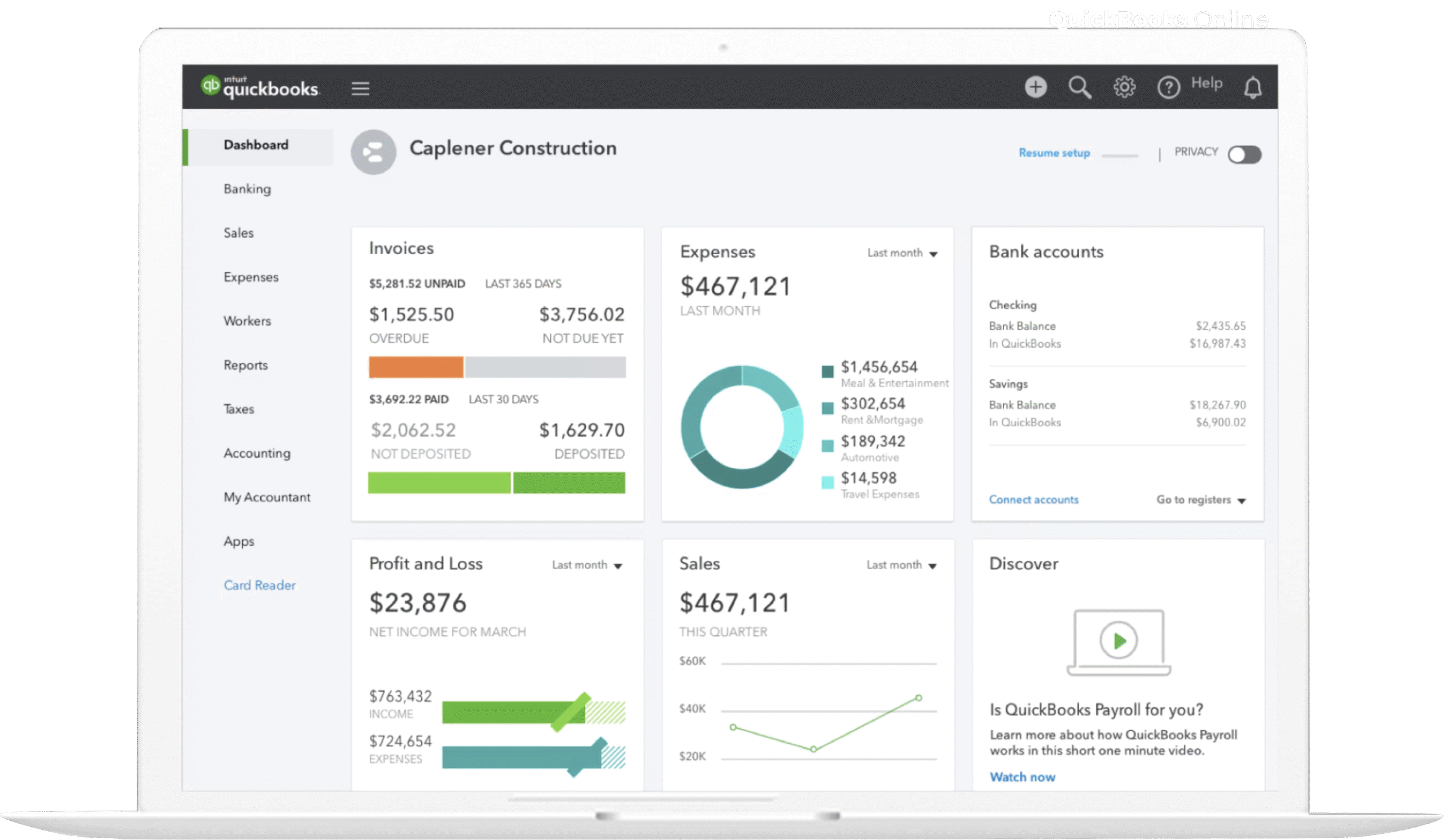

The Power of QuickBooks Desktop: Uncompromised Control.

Ideal for businesses that require robust reporting, multi-user access on a local network, or industry-specific functionalities (e.g., inventory management). We ensure a seamless transfer of your complex data from other systems or older versions of QuickBooks to the latest Desktop platform.

Key Benefits:

-

- Full data transfer including historical data.

- Installation and setup on your local network.

- Custom chart of accounts and item setup.

- Post-migration support and training.

The Freedom of QuickBooks Online: Access Anywhere, Anytime.

Perfect for business owners who need to manage their finances on the go, collaborate with their team or accountant easily, and access real-time financial data from any device. We’ll make your move to the cloud simple and secure.

Key Benefits:

-

-

Secure transfer of all financial records to the cloud.

-

Connecting bank and credit card accounts.

-

Setup of cloud-based invoicing and payment systems.

-

Training on the QBO interface and mobile app.

-

Our Migration Process: Quick, Easy, and Secure

At Quickfix Bookkeeping, we understand that migrating accounting software can feel daunting. Our expert team follows a meticulous, three-step process to ensure a flawless transition with minimal disruption to your business operations.

1. Consultation & Assessment:

We discuss your business needs, review your current software, and recommend the best QuickBooks platform (Desktop or Online) for you.

2. Secure Migration:

Our team executes the data transfer, meticulously checking for accuracy and integrity. We’ll keep you informed every step of the way.

3. Final Setup, Training & Ongoing Support:

We finalize your setup, connect bank feeds, and provide personalized training to you and your team so you can hit the ground running.

Why Trust QuickFix Bookkeeping With Your Financial Data?

- Expertise: Our team consists of Certified QuickBooks ProAdvisors with years of experience in data migration.

- Security: We use industry-leading security protocols to ensure your sensitive financial data is protected throughout the entire process.

- Personalized Service: We don’t believe in one-size-fits-all solutions. We take the time to understand your unique business needs and recommend the best path forward.

- Peace of Mind: With our meticulous process and ongoing support, you can be confident that your transition will be accurate and hassle-free.

Frequently Asked Questions

Does a C-series error mean I’ve lost all my data?

Not necessarily. While these errors indicate that a specific part of your data file is unreadable or inconsistent, it rarely means the entire file is gone. It usually means a specific link—like a report header or a transaction path—is broken. Performing a Rebuild usually restores these links.

Why do I get Error C=225 specifically when running reports?

Error C=225 is often triggered when QuickBooks attempts to “memoize” or recall a specific report format that has become corrupted in the program’s cache. It can also happen if there is a mismatch between your Windows version and your QuickBooks release.

Is Error C=260 related to my internet connection?

Often, yes. While it is a data error, C=260 frequently occurs when sending invoices via email or communicating with the payroll server. If the connection drops while the data is being “packaged,” QuickBooks throws this code because the data packet is incomplete.

What should I do if the "Rebuild Data" tool fails?

If the Rebuild utility hangs or gives you an “Error 8007,” do not keep trying. This suggests the corruption is deeper than the standard tool can reach. At this point, you should contact QuickFix Bookkeeping for professional data recovery to avoid making the damage worse.

How often should I "Verify" my data to prevent these errors?

We recommend running the Verify Data utility at least once a month, or immediately after a power outage or a computer crash. Catching a small inconsistency early prevents it from snowballing into a major C-series error.

Can a large file size cause C-series errors?

Yes. As your company file grows (especially over 250MB for Pro/Premier or 1.5GB for Enterprise), the database becomes more susceptible to indexing errors. Periodically condensing your data or starting a new “clean” file for a new fiscal year can significantly reduce these risks.

Does renaming the .TLG file delete my transactions?

No. The .TLG (Transaction Log) file is a backup log of changes made since your last full backup. Renaming it simply forces QuickBooks to stop trying to read a potentially corrupted log. However, you should always make a manual backup (.QBB) before renaming any system files.

Why does my antivirus software sometimes trigger these errors?

If your antivirus is scanning the QuickBooks file while you are trying to save a transaction, it can “lock” the file for a split second. QuickBooks then fails to write the data, leading to a C-series inconsistency. Always exclude .QBW and .TLG files from active background scanning.

Get Expert Help Today

If you’re stuck in a loop of C-series errors, don’t risk your financial history. Our team at QuickFix Bookkeeping can perform a deep-clean of your database and get you back to work in hours, not days.