Accounting & Taxation Services

Quickfix Bookkeeping

Expert Tax Filing & Compliance Services

Maximize your tax savings and eliminate filing stress with QuickFix Bookkeeping’s expert-led taxation services. We offer precise, timely, and compliant financial management that keeps your business ahead of deadlines and regulatory changes. Our dedicated tax professionals tailor strategies to suit your business needs, ensuring every deduction is captured and every return is filed accurately. With transparent, fixed-price plans and no hidden fees, you get cost-effective solutions and peace of mind. Whether you’re a small business or a growing enterprise, we help you stay tax-ready, compliant, and financially optimized—so you can focus on growth while we handle the numbers.

Features

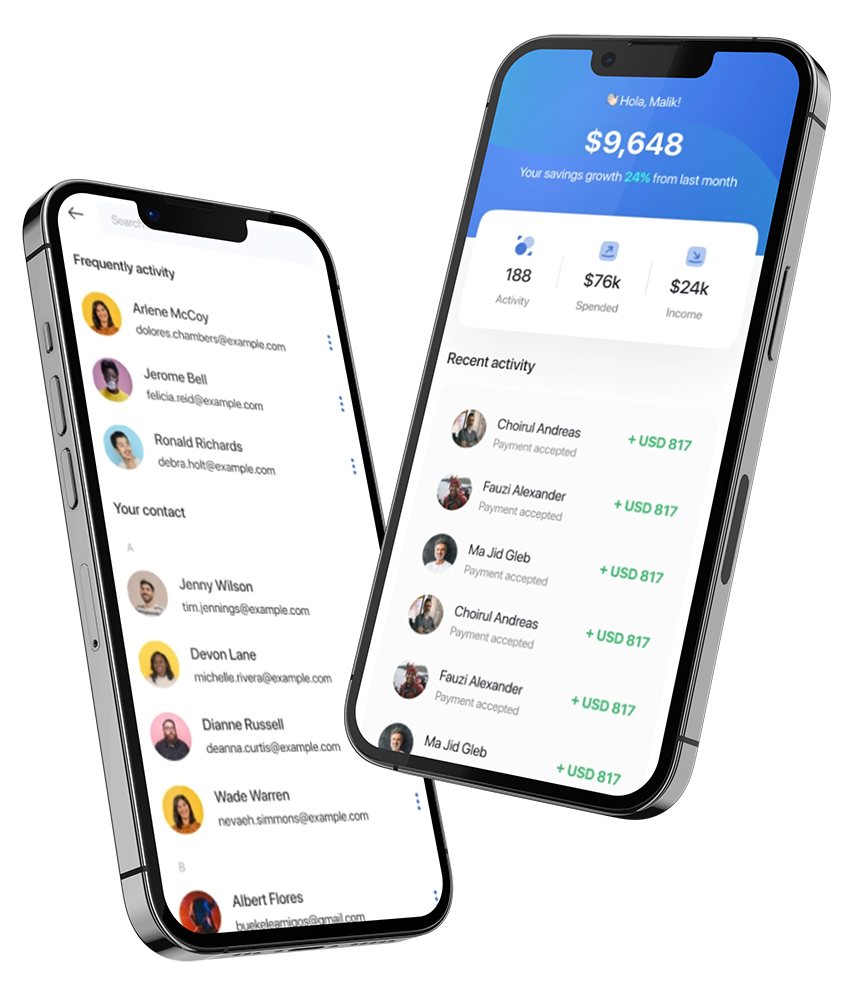

Seamless Tax Filing & Financial Reporting

Quickfix Bookkeeping delivers precise monthly and yearly tax reports, ensuring hassle-free compliance and maximizing your financial efficiency. Connect with our experts today!

Quickfix Bookkeeping

Why Hire Our Online Accountant?

Expert Tax Filing & Compliance Services FAQs

We handle federal, state, and local tax filings for individuals, small businesses, and corporations—ensuring accuracy and timely submission.

Our certified tax professionals stay updated on the latest tax laws and use detailed checks to ensure every return is fully compliant.

Yes, we offer assistance with back tax filings, resolving IRS notices, and negotiating payment plans or settlements on your behalf.

We provide year-round tax planning, compliance monitoring, and filing support to keep your finances on track at all times.

Through detailed deductions analysis, credits, and smart income structuring, we help reduce your tax burden and increase eligible savings.